Korea’s remarkable economic growth and democratic development have long been a source of global interest. In recent years, however, the booming appeal of its cultural phenomena—such as K-dramas, K-music, and Korean cuisine—have sparked unprecedented fascination with Korean society as a whole, elevating its prominence on the international stage. Reflecting this surge of enthusiasm, an increasing number of students and scholars are flocking towards the emerging discipline of Korean studies.

In line with this recent trend in academia, Seoul National University aspires to spearhead the development of contemporary Korean studies, exploring multidisciplinary fields and ultimately solidifying its status as a distinct academic discipline. The university already has a longstanding history of investing significant intellectual resources to the study of Korean history and literature, particularly through the Kyujanggak Institute for Korean Studies. Now, by integrating the historical and the contemporary, a more holistic understanding emerges of Korea's place within the broader global context. As expressed by SNU’s esteemed President Ryu Hong Lim, this new rigor in examining Korean contemporary society will unlock invaluable insights into universal human experiences and challenges, paving the way for innovative, future-oriented solutions.

The Seoul National University Contemporary Korean Studies (SNU CKS) research institute was established to more comprehensively advance scholarship on contemporary Korean affairs. As of 2024, approximately 50 researchers and research assistants from SNU and other Korean universities are collaborating with international researchers in the form of an extensive joint research group. In addition, the institute endeavors to foster a platform where scholars can share insights and all participants can engage in open dialogue, such as through an open seminar series. On January 10, the SNU CKS institute hosted the second session of such a series, featuring guest speaker Professor Stephen Haggard, a renowned academic and Research Director for Global Governance at the University of California Institute for Global Conflict and Cooperation (IGCC). Titled “Korea and the Securitization of International Political Economy,” Professor Haggard’s presentation offered a concise examination of how evolving trends in International Political Economy (IPE) are shaping Korea’s foreign policy.

The poster for “Korea and the Securitization of International Political Economy”

Professor Haggard began by asserting a definite shift in the field of IPE, with increasing attention being paid to the relationship between economics and security. Though this relationship has been the subject of intense debates within policy circles and think tanks, there is still a lack of sufficient academic literature on the topic. Professor Haggard proposes five key dimensions to consider: 1) the role of foreign economic policy in grand strategy, 2) the weaponization of interdependence and “derisking,” 3) the return of strategies of denial: technology and export investment controls, 4) the wider ideational return of industrial policy and its international implications, and 5) new governance structures: “resilience alliances,” friendshoring, and plurilateral agreements.

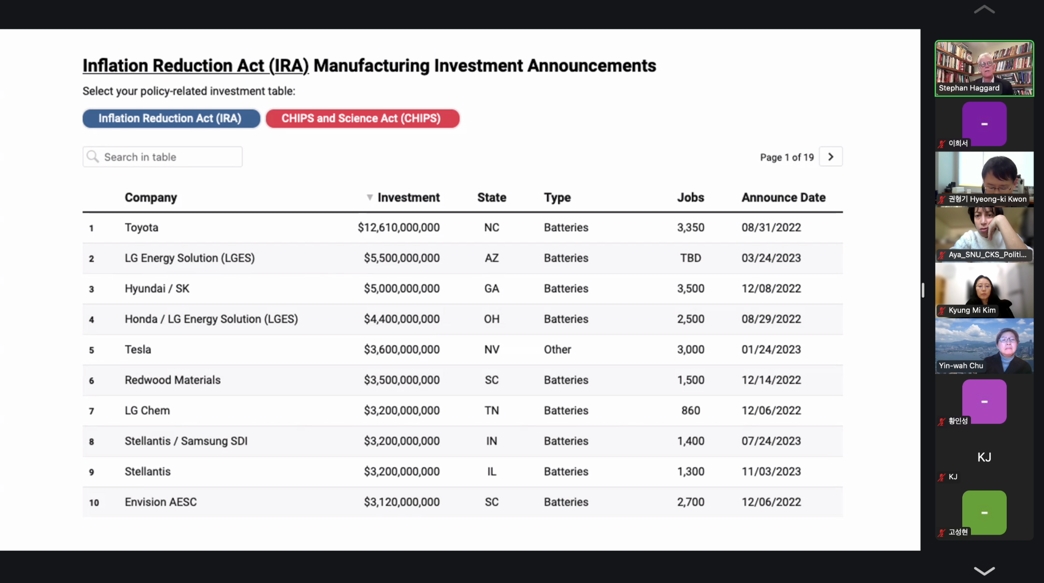

Among them, Professor Haggard highlighted the resurgence of industrial policy as one of the most interesting developments of the past decade. During the Biden administration, in particular, substantial support was directed towards green energy transition and the semiconductor industry, passing landmark legislation, including the Inflation Reduction Act (IRA), the CHIPS Act, and the Infrastructure Investment and Jobs Act. These measures were taken to fulfill a vital objective of the United States’ industrial policy: catalyzing both domestic investment and foreign direct investment into the country. Korea emerges as a key actor in providing this foreign direct investment, with several billion-dollar investments by major firms—including LG Energy Solutions (LGES), Hyundai, and Samsung SDI—being incentivized by the IRA.

Major firms incentivized by the Inflation Reduction Act (IRA)

However, this does raise the question of whether potential investments are being diverted away from Korea and if the United States’ industrial policy stimulates policy initiatives in response. The timing of Korea’s own policies seems to lend some merit to this belief, among them the Amendments and the Enforcement Decree on the 2020 Act on Prevention of Divulgence and Protection of Industrial Technology and the Advanced Industries Act of 2023. In other words, significant policy actions taken on by the United States are directly felt in impact by Korea, further prompting protective measures of its own.

Overall, Professor Haggard’s presentation outlined the dynamics of foreign economic policies and their far-reaching impact, with a special focus on Korea’s influence by and on major powers. In doing so, he also tackled the interdisciplinary essence of contemporary Korean studies, spanning from politics, the economy, society, culture, and religion to engineering and technology. This all-encompassing approach ultimately shed light on how Korea can navigate its increasing status and participation on the world stage.

Stay tuned for upcoming lectures in the seminar series, along with other academic events hosted by the Seoul National University Contemporary Korean Studies (SNU CKS) institute. With its dedication to advancing a burgeoning field of research and study, there is much more to be anticipated.

Written by Hee Seo Lee, SNU English Editor, heeseolee@snu.ac.kr