On November 12, Seoul National University’s Graduate School of Public Administration (GSPA) hosted its 1,110th Policy and Knowledge Forum, titled “Sustainable Finance and Environmental Policy.” Moderated by Professor Park Soonae (Graduate School of Public Administration), the forum featured Choi Chi-yeon (Director of the Fair Market Division at the Financial Services Commission [FSC]) and Professor Kim Byeong Jo (Graduate School of Public Administration), as well as several other SNU professors who were on the floor.

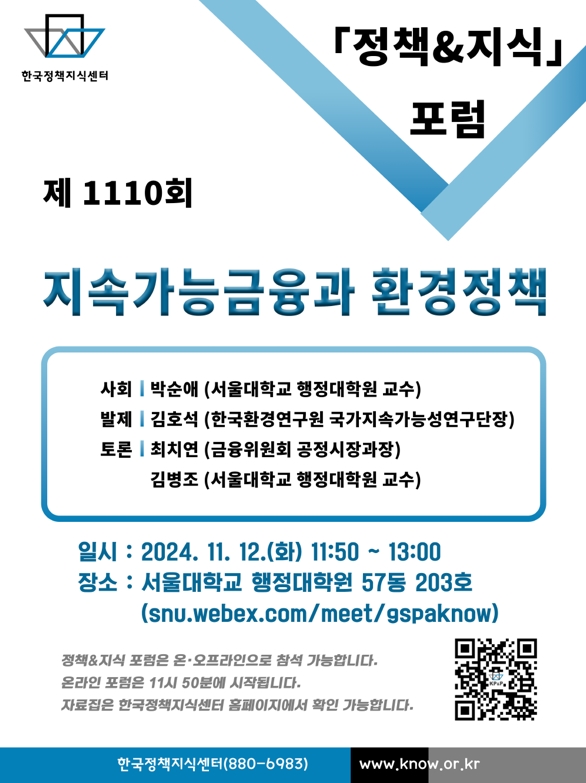

The poster for “Sustainable Finance and Environmental Policy”

Defining and Tracing the Evolution of Sustainable Finance

Kim Ho Seok (Chief Research Fellow and Chair of the Research Group on National Sustainability at the Korean Environment Institute [KEI]) opened the forum by introducing key concepts and developments in sustainable finance. During his presentation, he defined two fundamental concepts of the framework: the “green premium” and the “green-adjusted input price”. The green premium refers to the additional revenue that corporations with “greener” performance receive, reflecting consumers’ and investors’ preference for eco-friendly products in this age of heightened ecological consciousness. Meanwhile, the green-adjusted input price entails changes to the cost of inputs based on where a corporation stands in relation to an established environmental benchmark. Sustainable finance reshapes both revenue and cost structures, incentivizing corporations to increase production and reduce emissions by making strides in improving their environmental performance.

In recent decades, corporate sustainability disclosure has evolved into a well-established and widely adopted practice. Its beginnings may be traced back to the inclusion of a compelled disclosure clause in the U.S. National Environmental Policy Act (NEPA) in 1970. More wide-reaching requirements for social audits have been established since then, with the implementation of the EU’s Corporate Sustainability Reporting Directive (CSRD) in 2023 marking a significant milestone.

Kim Ho Seok delivering his opening presentation for the forum

Voicing the Perspectives of the Government, Investors, and Corporations

Representing the Financial Services Commission, Choi Chi-yeon outlined various governmental efforts to achieve carbon neutrality by 2050 and to aid corporations in addressing the climate crisis. Choi delved into the agency’s plan to enhance its support for climate action, such as by strengthening the role of financial institutions in facilitating low-carbon transition and investment in the low-carbon facilities, product manufacturing, and technology. Other key objectives include establishing a new future energy fund and driving major investments in climate technology through public-private partnerships.

Furthermore, Choi conveyed the perspectives of investors and corporations, noting that a survey of 17 foreign investors revealed strong, unified support for mandatory corporate sustainability disclosure. In fact, these investors emphasized that issues of sustainability beyond climate action are just as significant and should be addressed with greater transparency. Additionally, while recognizing the challenges of measuring and reporting on Scope 3 greenhouse gas* emissions, they deem such data crucial to accurately assessing corporate risk.

According to Choi, corporations do also agree on the need for mandatory disclosure on climate-related matters. However, they differ in their stance on reporting Scope 3 emissions. Given the lack of standardization in assessment and the fact that certain global powers do not require such reporting, many corporations maintain that Scope 3 emissions reporting should by no means be compulsory.

The Financial Services Commission stands by the need to prioritize climate disclosure and the belief that clear guidelines or more specific, actionable examples for doing so—such as best practices—are essential. Moving forward, by considering the diverse and often divergent opinions of investors and corporations, the Commission will focus on achieving policy goals while also identifying areas where it can enhance the feasibility of implementation for businesses.

Choi Chi-yeon representing the Financial Services Commission

Ultimately, the forum provided a valuable platform for many insightful discussions and expert opinions. We must remember that sustainable finance is not only a crucial approach to financial decision-making but also imperative in ensuring the health and resilience of our global future.

* Scope 3 greenhouse gas emissions are indirect emissions that occur in a company’s value chain, such as from suppliers, product use, and employee commuting, which are not directly controlled by the company.

Written by Hee Seo Lee, SNU English Editor, heeseolee@snu.ac.kr